Homeownership

Waco Habitat for Humanity believes in offering a hand up out of poverty housing, not a hand out. We’re on a mission to provide affordable housing and our homeowners join this mission. Our homebuying program helps low-income families escape poverty housing by building and buying an affordable home. Waco Habitat for Humanity sells homes to qualified applicants through a 30-year 0% interest-rate mortgage.

If you are interested in becoming a Habitat homeowner, please read the requirements below to see if you may qualify.

To be accepted into the homebuyer program, you must:

- be a U.S. citizen or legal resident

- live or work in Waco-McLennan County for the past 12 months

To be accepted into the homebuyer program, you must demonstrate at least one (1) of the following:

- Currently living in housing that is overcrowded or in bad condition

- Currently paying 30% or more of your income for housing

- Currently unable to secure decent housing through other means, such as a conventional market loan

To be accepted into the homebuyer program, you must:

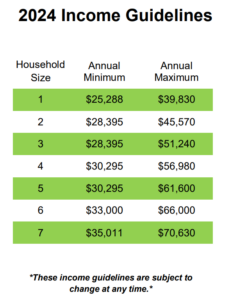

- Have stable income between 40% and 70% of the median income of Waco-McLennan County (Housing is considered affordable when the household pays no more than 30% of its total monthly income toward housing. We follow this guideline. If your income level would require you to spend more than 30% of your income on a Habitat mortgage, you may not qualify for our program. See the Qualification Income Limits chart below for local income limits.)

- Demonstrate an ability to make regular monthly payments for rent, utilities and other credit obligations, including mortgage payments, real estate taxes, and homeowner’s insurance. We will help determine if this payment will jeopardize your ability to meet all of your family’s financial obligations and expenses.

- Have been at current place of employment for at least one year

Qualification Income Limits

- Be able to save $1,800 while in the New Homeowner Program.

- Fulfill required “sweat equity” hours

- Disclose financial and personal information, including employment references, proof of income, payment stubs and records, etc.

- Complete Habitat program application requirements

- Attend all homebuyer workshop classes

- Promptly make monthly home mortgage payments

- Maintain and repair the home after occupancy

How to apply for the New Homeowner Program

Step 1: Evaluate your eligibility and readiness

Habitat homeowners help build or repair their homes alongside volunteers and pay an affordable mortgage. To qualify, applicants must meet general eligibility requirements and have a need, the ability to pay, and a willingness to partner with Habitat. Applicants can evaluate their readiness for homeownership by completing the self-assessment and reviewing the FAQ below.

Step 2: Get an application by attending our Homeownership Information Session

No pre-registration required**

Step 3: Complete the application and gather all required documents

Copies of all required documents must be submitted with your application. All supporting documentation submitted with the application will be kept and cannot be returned to the applicant. Please do not bring originals, copies can be made at our office.

Step 4: Submit your application

Applications can be submitted in person with the $35 application fee (check or money order.) They cannot be received electronically.

If you have questions or need to speak with someone about an application, contact Joshua Martinez at (254) 756-7575 or joshua@wacohabitat.org. To limit personal contact, processing questions will be handled by phone, email, or mail. If Habitat determines an in-person meeting is needed, an appointment will be required.

Step 5: Watch your mail for communication from Habitat regarding the status of your application

As Habitat goes through the processing steps, you will be notified if any additional information is required from you. All notifications regarding the status of an application will be mailed to the applicant’s address. Please notify Joshua Martinez of any changes to the applicant’s contact information throughout the application process.

Homeowner Information Session Interest Form

Please insert your information down below to receive all of the updates on our Homeownership Program.

Frequently Asked Questions

People in your community and all over the world partner with Habitat to

build or improve a place they can call home. Habitat homeowners help build

their own homes alongside volunteers and pay an affordable mortgage.

Other housing resources and information

- Check out resources at the Texas State Affordable Housing Corporation (TSAHC) website, where you can take their eligibility quiz (separate from Habitat for Humanity program) and learn about down-payment-assistance (some Habitat for Humanity homebuyers may be eligible for down-payment-assistance). TSAHC is is a statewide nonprofit corporation created at the direction of the Texas Legislature.

- Learn more about Texas Bootstrap program.

- Not ready to buy a home? Find information about U.S. Housing and Urban Development (HUD) rental assistance programs.

- Did you know we also offer financial counseling to the public? Contact Homebuyer Services for more information about availability and our next classes.

The selection of homebuyers who purchase Habitat homes is considered by the Loan Committee with final approval from the Waco Habitat Board of Directors, using criteria that does not discriminate on the basis of race, gender, ethnicity, age, handicap, religion, marital status, or because all or part of the applicant’s income is derived from public assistance programs.